‘Resilient’

Product & DD/Risk

Management

How do we think about investment products in Digital Assets?

Want to dive deeper into our risk management and key procedures?

Request our data room by emailing [email protected]

with subject line: Data Room

risk management approach

Institutional Grade Risk Management To Protect Downside

We have a dashboard through Haruko to track real-time positions and performance for our SMAs. For funds, we get daily or weekly updates from managers, as well as bi-weekly or monthly reporting including counterparty risk, portfolio composition, and performance metrics.

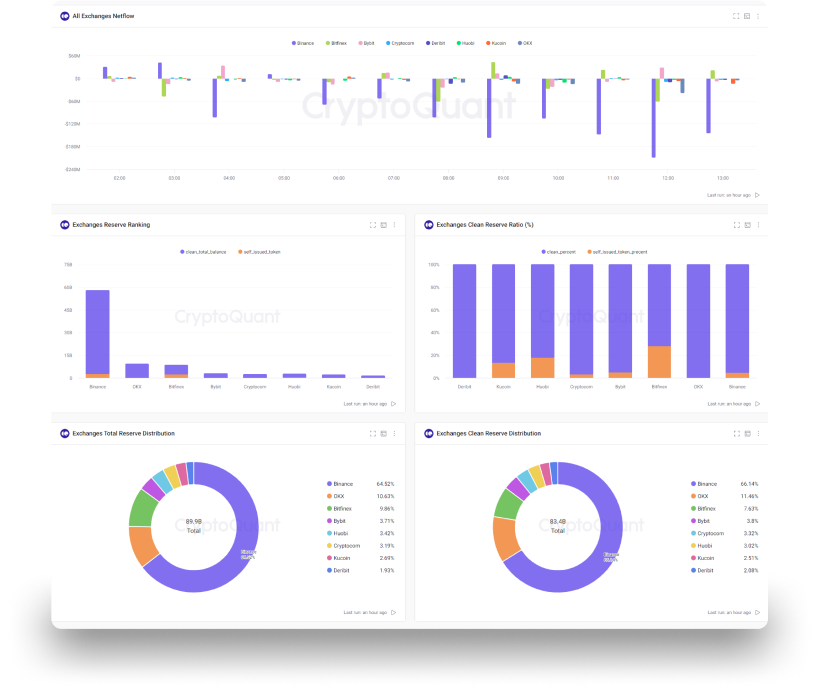

Additionally, we have real-time monitoring and alerts with exchange outflows, on-chain activity, and price fluctuations to indicate any anomalies or significant changes in the market environment.

We get counterparty & portfolio exposure from underlying funds bi-weekly. We track max limits and ensure it doesn't exceed 20% (soon 15%) for any counterparty. We then tie this to Amphibian Unite (see on below) and soon our dashboard.

We implement rigorous cash and BTC management practices both internally and with our underlying funds. We collaborate with a top custodial platform for receiving BTC and ETH, which requires multiple verification steps to whitelist addresses and process transactions. Additionally, we prioritize sending transactions securely and work closely with each underlying fund to ensure best practices in custodianship and cybersecurity.

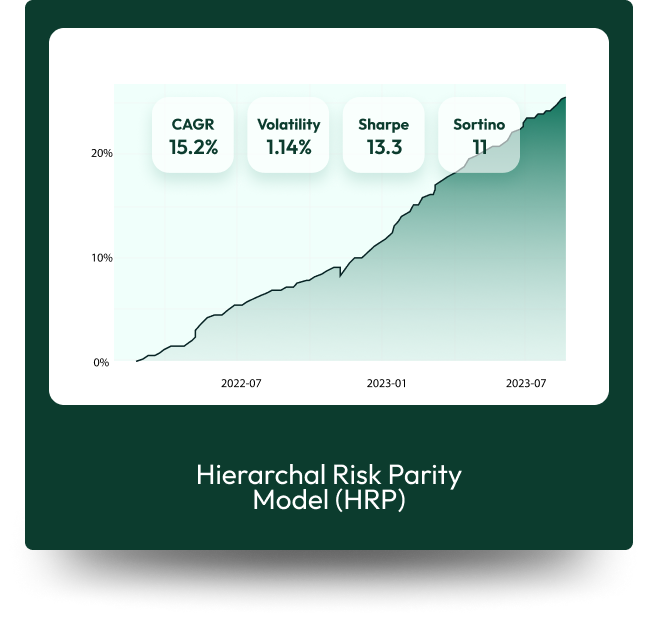

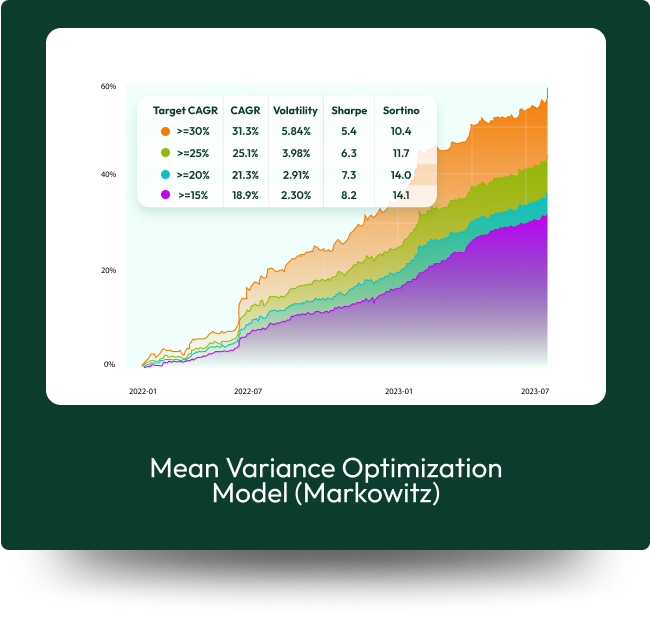

With 26 months of live data from ETH & USD, we understand which strategies pose potential risk in which market conditions. Furthermore we receive the daily pnl data from each underlying fund and feed through our algorithm, so we can determine the correlation between each strategy and how to maximize sharpe & returns, while minimizing volatility and drawdown.

We get counterparty & portfolio exposure from underlying funds bi-weekly. We track max limits and ensure it doesn’t exceed 20% (soon 15%) for any counterparty. We then tie this to Amphibian Unite (see on below) and soon our dashboard.

With 26 months of live data from ETH & USD, we understand which strategies pose potential risk in which market conditions. Furthermore we receive the daily pnl data from each underlying fund and feed through our algorithm, so we can determine the correlation between each strategy and how to maximize sharpe & returns, while minimizing volatility and drawdown.

We have a dashboard through Haruko to track real-time positions and performance for our SMAs. For funds, we get daily or weekly updates from managers, as well as bi-weekly or monthly reporting including counterparty risk, portfolio composition, and performance metrics.

Additionally, we have real-time monitoring and alerts with exchange outflows, on-chain activity, and price fluctuations to indicate any anomalies or significant changes in the market environment.

We implement rigorous cash and BTC management practices both internally and with our underlying funds. We collaborate with a top custodial platform for receiving BTC and ETH, which requires multiple verification steps to whitelist addresses and process transactions. Additionally, we prioritize sending transactions securely and work closely with each underlying fund to ensure best practices in custodianship and cybersecurity.

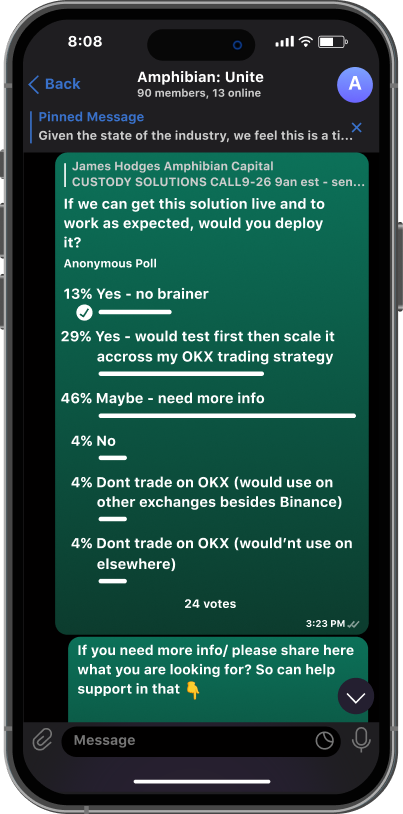

We created a consortium of 159+ of the world's leading traders and managers, run diligence and monitor market/counterparty risk. This allows us to protect investors and creates upside potential too.

Post FTX was the first time funds were willing to collaborate. Now we have diligence & monitoring across all counterparties not just centralized, but decentralized across all of our funds too.

This gives us a significant edge as we are likely to identify events before they happen, and it helps us identify signal (amongst noise), determine what's real risk vs not and identify trading opportunities when events are happening (that cause larger inefficiencies in the market).

Our 7 Step

Risk Management Process

Step #1

Create Portfolio

targets

- Targeting 12-15%+ Net Annually

- Max DD from overall portfolio strategy < 1.5%

- Volatility target < 10, Sharpe target > 5

- 30 day liquidity target for managers

- Any form of Correlation < 0.15 to S&P500

Step #2

Identify

Key Risks

Taking a Similar Approach to Traditional Assets

Step #3

Source & Diligence

Underlying Investments

Example for Amphibian Capital that eliminates 98% of funds

| Key Point | Key Point Specifics | Checklist |

| Amphibian has reviewed deck/fact sheet | Includes team, background, history, types of strategies, where referral of fund came from, who do we know who has invested, Amphibian has reviewed deck/fact sheet with them or worked with them etc. | |

| Meet scoring system criteria | Assesses max dd, returns since inception, aum, win months, sharpe/calmar/sortino, liquidity etc. | |

| Initial intro call with Operations Analyst | Aines to schedule: [email protected] | |

| 92-point integrity Checklist | Complete Form with all questions | |

| Technical DD Call | With Ivailo, James, Todd if form meets standards | |

| Vetted Counterparty Risk Deeply | Vetted counterparties they work with, how they vet, monitor/receive alerts, reduce risk and make sure they meet criteria |

|

| Hedged Exchange Risk | Use Copper Clearloop, have collateral sitting outside of exchange, diversified to right exchanges or other methods to reduce risk as much as possible |

|

| Data plugged into our algorithm | Sent daily pnl data for at least 6 months worth of data | |

| Third party verification | Fund admin and auditor have confirmed they work with fund and they have full access to bank accounts/trading history logins etc (vs spreadsheets) | |

| Background Check | Complete on Founders/Managers through 2-3 current investors and/or through more formal processes also |

|

| Side Letter | Risk limits with penalties, liquidity terms, fees | |

| Live Data | Have at least 120 days worth of live trading data with minimum $2M AUM | |

| API Access & Wallet address | Given API access to exchange so we can monitor risk limits and track wallet address | |

| Bi-Weekly Report | Willing to commit to spending 5-10 mins every two weeks to send a bi-weekly report with returns, current positions, counterparty risk exposure (% across exchanges etc.) |

|

| Member of Amphibian: Unite | Must be willing to join our telegram group with all our funds- an Industry consortium to share updates, ideas, collaborate etc on managing risk |

|

| Amphibian Portfolio Committee | Amphibian Portfolio Committee votes on accepting new fund into portfolio after reviewing feedback from CIO |

|

| Start Small & Grow | Start at $100k USD equivalent for month 1 and scale from there as relationship with new manager grows |

Step #4

Mitigate or Eliminate

Counterparty Risk

Example here of one off exchange settlement provider

Copper Clearloop and their Value Proposition:

ClearLoop enables clients to delegate funds and trade on multiple

exchanges, with settlements occuring on the Copper infrastructure.

Mitigate counterparty risk

Significantly reduce network fees

Increase capital efficiency

Settle off exchange

Optimize operational workflow

Diminish exchange wallet tracking

Step #5

Diversify To Create Superior

Risk-Adjusted Returns

Run Algorithmic Simulations To Understand

Correlation Amongst Our Portfolio and Optimal Allocations

Step #6

Risk Dashboard

We are continuing to develop our risk management

procedures and tech in-house too.

Step #7

Active Monitoring

We track daily PNL data for almost every fund. If daily is not possible, minimum bi-weekly.

Then we have Amphibian Unite (our consortium of 159 of the world’s leading traders & managers) to manage Counterparty Risk through intelligence of the World’s

best traders.

Request our data room by emailing [email protected]

with subject line: Data Room

What Our Current LPs Are Saying About Amphibian Capital

There’s a level of consistency and repeatability that shows they have strong manager selection skills

“I’m an investor in Amphibian because I believe they’re the best crypto quant fund of funds. The return on my ETH has far exceeded my expectations, and there’s a level of consistency and repeatability that shows they have strong manager selection skills. This is a fund that operates with discipline and the foresight needed in digital assets.”

Joey Krug

Partner at Founders Fund Former Co-CIO Pantera Capital

I feel more informed and better positioned for long-term gains

I had moved a substantial part of my portfolio from tech stocks into the ETH fund of funds, just before the FTX chaos hit. The risk and volatility in late 2022 were beyond anything I’d faced, but Amphibian's team was ready. Todd and James calmed my nerves with clear, frequent updates and even personal conversations. Now, I feel more informed and better positioned for long-term gains, thanks to their unique strategy and seasoned leadership.

James Workman

Founder AquaShares Inc.

Their diligence in analyzing our trades and strategy is both thorough and highly specific.

"I’ve had the pleasure of working with Amphibian Capital for nearly three years. Their diligence in analyzing our trades and strategy is both thorough and highly specific. They possess a deep understanding of various risk types and the corresponding expected returns. Amphibian Capital stands out as the most sophisticated and knowledgeable fund of funds I’ve encountered in this industry.""

Hugo Xavier

Co-Founder and Head of Trading K2 Trading Partners

Consistently deliver results with a disciplined approach

“We’ve seen James and his team at Amphibian consistently deliver results with a disciplined approach. Our confidence as experienced allocators is unwavering.”

Bendik Loevaas

CEO Jigeum Capital

Highly skilled and genuinely focused on aligning with their investors’ goals

"I have a lot of confidence in Amphibian Capital's team and their thoughtful, steady approach to navigating the volatile world we live in. Their performance has been stellar since I invested. What I value the most is the trust I’ve built with their leadership. The team is highly skilled and genuinely focused on aligning with their investors’ goals. I feel like a true partner in their journey, which has been a meaningful experience and most importantly we are all aligned in having pure intention of giving back via donating a large proportion of profits to worthwhile causes."

Ben Arbib

Founder Nurture Brands

The balance between risk and performance is well articulated and transparent

"I have been very pleased with the consistent performance of the funds I am invested in and the professionalism of team at Amphibian Capital. The balance between risk and performance is well articulated and transparent and the founders have always been generous with their time to provide market insight and answer questions. Whilst the BTC and ETC funds don’t have a long track record, I wouldn’t hesitate to recommend Amphibian Capital to friends and colleagues due to reasons aforementioned, including reliability."

James Burbidge

Managing Director Deutsche Bank

The testimonials provided are from Current Clients, Limited & General Partners of Amphibian Capital.

No compensation was provided for the statements, and the statements do not present any material conflicts of interests.