Amphibian Capital Thesis

It’s Simple…

- We are bullish on BTC & ETH over the next 5-10 years

- We expect volatility & inefficiency in the market to continue

- 10-20+ year target: 2-3x+ ETH, BTC and/or USD over this time period

- Current target: 2-4% net per quarter

See our performance by fund here:

Not Your Keys, Not Your Coins They Say...

Even Cold Storage has Risk. Is 0% yield still worth it?

BTC on BTC Yield Live &

Pro-Forma Results*

Amphibian BTC Alpha Pro-Forma Net

Performance Since 1/1/19: 144.57% (BTC on BTC)

*Pro forma performance, representing the average annualized performance from January 2019 through July 2023, net of all fees, for the portfolio of underlying funds that Amphibian Fund invested in beginning on August 1 2023, if the same portfolio had been fully invested as of January 2019 with no rebalancing. Please note each fund was added to the portfolio at a different time, and beginning on August 1, 2023 actual net fund performance is included. All underlying fund performance has been included from the date each fund was added to the portfolio. Note each underlying fund is the best estimate we have for the BTC share class. Not all were live as long as USD funds (so subtracted off funding costs etc for those time periods). This fund selection mirrors our latest ETH portfolio and a number of lessons from 13+ months of live data with that portfolio. In years prior to 2023, we’ve done our best to keep allocations to the max limits and adjust accordingly. Also know weightings over time would be slightly inaccurate as month on month weightings shift, depending on terms. **The Fund had approximately 5% exposure to FTX in November. This was marked as zero, but anticipate a high % of recovery given $7.3B has been recovered (30-50c on the dollar) ***Best projected estimate for September as of 9/27/24.

Grow BTC on BTC, While Minimizing Risk…

Amphibian Capital’s conservative target is 12%-15+% net APY yield to create more Alpha for long term BTC holders (USD/ETH also), while derisking through one of the world’s first fund of funds approach

ROBUST DILIGENCE

& RISK MANAGEMENT

- Institutional grade risk management, 98% of funds don’t meet standards

- Yield achieved through inefficiency and volatility of crypto vs purely direction

- 5+ sharpe, portfolio optimized through our proprietary algo & 13 months of live data in USD/ETH funds

LIQUID, LOW CORRELATION ASSET CLASS

- 0.09 correlation of yield to traditional assets & BTC price

- Monthly liquidity (after 6 month lock-up)

-

Fund of funds model to diversify

strategies & manage risk

Targeting CONSISTENT RISK-ADJUSTED RETURNS*

- 12%-15% net target in non-bull years

- 75%-100%+ target net returns across potential 4 year cycle**

- Counterparty Risk***: -1.54% annual average impact across last 5 years

*Pro forma performance, representing the average annualized performance from January 2019 through July 2023, net of all fees, for the portfolio of underlying funds that Amphibian Fund invested in beginning on August 1 2023, if the same portfolio had been fully invested as of January 2019 with no rebalancing. Please note each fund was added to the portfolio at a different time, and beginning on August 1, 2023 actual net fund performance is included. All underlying fund performance has been included from the date each fund was added to the portfolio. Note each underlying fund is the best estimate we have for the BTC share class. Not all were live as long as USD funds (so subtracted off funding costs etc for those time periods). This fund selection mirrors our latest ETH portfolio and a number of lessons from 13+ months of live data with that portfolio ** Not a promise or guarantee the crypto 4 year cycle will continue *** Only one major counterparty ‘exchange’ event impacted our underlying funds by more than 3% total AUM in the last 5 years. Avoided all others. That was with FTX and approx 4.5%-6% impact on our USD & ETH fund. This breaks down to 8.5% exposure on USD, current bids on secondary markets and potential forecasts indicate a likelihood to recover 30c-50c on the dollar. This translates to 4.5%-6% potential impact). Outside of this, we had one other event from an underlying fund with 2.7% portfolio drawdown. This translates to approximately 1.54% average counterparty risk across the last 5 years. Our max portfolio strategy drawdown monthly target is < 1.5%, our max counterparty drawdown target is less than one year of yield target with -9.9%.

Cold Wallet vs Amphibian Capital: Opportunities

Most investors don’t leave cash in a bank at 0%. Is it time to rethink BTC or ETH?

DIVERSIFICATION

98% of funds don’t meet our vetting and due diligence criteria. Our Fund of Funds strategy spreads investments across multiple BTC-focused strategies, reducing exposure to the risks associated with holding a single asset in cold storage.

ALPHA GENERATION

Through active trading, various market neutral strategies, arbitrage, liquidity providing and other strategies, we aim to generate alpha on top of BTC price appreciation, providing potential for higher returns compared to passive holding.

PROFESSIONAL MANAGEMENT

Our experienced investment team handles the complexities of trading, risk management, and strategy selection, leveraging 13 months of live data in our USD/ETH fund and decades of experience in crypto/tradefi. This allows investors to optimize returns while managing risks effectively.

DELEGATED RESPONSIBILITY

Investing in the Fund of Funds allows investors to delegate the responsibility of managing BTC to experienced professionals, relieving them of the burden of securing and managing private keys.

There Are Many Strategies Quant Funds Use.

Here Are 4 Key Ones

Digital assets quant strategy #1

Infrastructure: Market Making & Liquidity

Risk is low in this strategy as you’re not trading based on price, but on market inefficiencies.

There are numerous barriers to entry, so for new entrants it’s harder to compete than other strategies.

Market makers create value as they make markets more efficient and ensure customers can easily buy/sell on different platforms.

Market liquidity is asymmetrical. It is high in a bull market and thin in a bear market. Market makers are needed in challenging markets.

Market makers create value as they make markets more efficient and ensure customers can easily buy/sell on different platforms.

Risk is low in this strategy as you’re not trading based on price, but on market inefficiencies.

Market liquidity is asymmetrical. It is high in a bull market and thin in a bear market. Market makers are needed in challenging markets.

There are numerous barriers to entry, so for new entrants it’s harder to compete than other strategies.

Market making provides liquidity on a defined digital asset.

This is done by submitting bid & ask limit orders on a digital asset exchange.

Profit is made by collecting bid-ask spread over multiple trades.

- Market making provides liquidity on a defined digital asset.

- This is done by submitting bid & ask limit orders on a digital asset exchange.

- Profit is made by collecting bid-ask spread over multiple trades.

Digital assets quant strategy #2

Arbitrage

Basis Arbitrage

Actively trading the futures curve to benefit from changes in the basis of futures contract prices. Leveraging the difference between the spot & futures price.

Statistical Arbitrage

Using a volatility-adjusted statistical arbitrage opportunity detection strategy based on two machine learning classification algorithms. The model uses 33 digital assets selected for their liquidity and market capitalisation to produce a strong & robust prediction signal with long/short positions.

Funding Rate Arbitrage

Capture funding rates across different coins, use automation to optimize, can capture up to

30-50% returns from speculatory retail demand.

currency pair arbitrage

We aim to capture the price differences between exchanges and digital assets/fiat pairs. With thousands of small trades we target fully hedged, arbitrage trades with strong market-neutral profits.

Digital assets quant strategy #3

Algorithmic & Systematic

Delta-Neutral

This strategy seeks low correlation to both digital assets and traditional indices by employing a delta-neutral approach, combining longs and shorts in various crypto assets to balance out sensitivity to individual price movements. The goal is to capture returns primarily from volatility or the passage of time, regardless of which direction BTC and ETH prices go.

Automated Machine Learning

Our investment strategy utilizes a data-driven approach to uncover potential opportunities and manage risk through a combination of quantitative analysis and expert insights. We aim to achieve superior risk-adjusted returns by identifying and combining multiple small signals.

Digital assets quant strategy #4

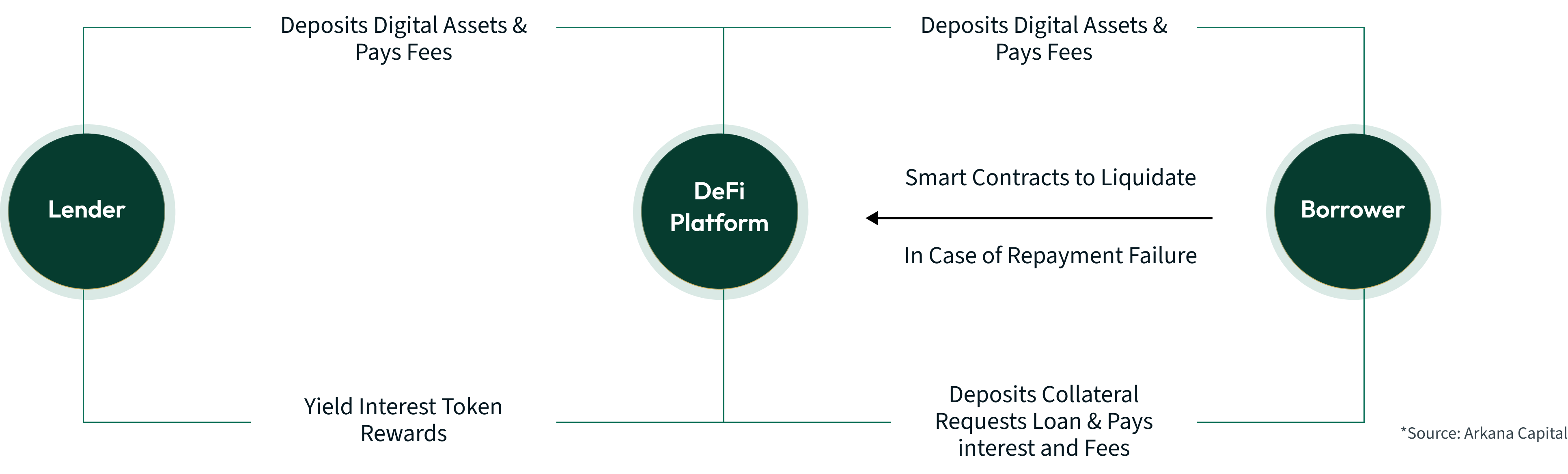

DEFI Yield Farming Overview*

Yield Farming Explained

Yield farming can be defined as the practice of staking or lending digital assets in order to generate returns and/or rewards in the form of additional digital assets

Demand / Borrowing Incentive

1. Borrow to participate / arbitrage

2. Lower interest rates

3. Low availability of borrowed coin

4. HODler of collateral

Supply / Lending Incentive

1. Share of transaction fee

2. Interest from borrower

3. Participation in governance

4. Price upside on tokens received

Deeper Portfolio Selection Process

Amphibian Capital Fund Selection Details

01

PROPRIETARY SCORING SYSTEM

Our scoring system ranks our top 50 funds based on past performance, max drawdown, risk (sharpe ratio), % of winning months, size, liquidity etc. This comparison gives our investment selection team the data to discuss qualitative factors and create a proposed portfolio, before a deeper vetting process.

02

110 POINT INTEGRITY CHECKLIST

Our 110 point integrity checklist is the first stage of vetting. We have 85 questions to test each fund’s risk policies across security, technical, counterparty, stablecoins and other critical procedural points. We also review their trading strategies, portfolio exposure per trade, internal systems, track record, team, fund terms, operational procedures, etc.

03

SECURITY, RISK MANAGEMENT & TRADING INTERVIEWS

After stages 1 and 2, the final selection process is deep calls between our team and the underlying funds. We are not only reviewing their integrity checklist, but ensuring they can continue to deliver on past performance, we have immense trust with them and their trading strategies continue to be sustainable.

Portfolio Optimization Methods

Amphibian Algorithm: A Comparison of 6 Models We Ran Large Data Sets

of Pnl Data of Underlying Managers Through to Optimize to Target

Superior Risk Adjusted Returns

01

Equal weight

We use as benchmark for a naïve allocation.

02

Mean Variance

Optimization

(Markowitz method)

- Maximizes the expected return for a given level of risk or minimizes risk for a given level of expected return.

- Uses statistical measures of mean (expected returns) and variance (risk) to find an optimal asset mix, via random permutations.

- https://quantpedia.com/markowitz-model/

03

Momentum z-score

- Utilizes momentum, the tendency of an asset’s price to persist in the same direction.

- The z-score is used to measure how many standard deviations an element is from the mean, applied to the momentum to understand if the current momentum of a fund is stronger or weaker than other funds. Funds are weighted by the magnitude of their recent z-score, with modifications to prevent negative weights.

- https://www.msci.com/eqb/methodology/meth_docs/MSCI_Momentum_Indexes_Methodology_Aug2021.pdf (pages 3-5)

04

Risk Parity

- Equalize risk contributions from various funds.

- Allocates capital to assets based on the individual fund’s risk level to ensure each has an equal impact on the portfolio’s overall risk (volatility).

- https://www.aqr.com/-/media/AQR/Documents%20Insights%20White-Papers%20Understanding-Risk-%20Parity.pdf

05

Hierarchical Risk Parity (HRP)

- Utilizes hierarchical clustering to understand fund similarities.

- A machine learning method that constructs a diversified portfolio by grouping assets into clusters, identifying relationships, and then optimizing allocation accordingly, to minimize variance (volatility) and avoid exposure to highly correlated assets.

- https://hudsonthames.org/an-introduction-to-the-hierarchical-risk-parity-algorithm

06

Combined methods

- Create portfolios formed by the combination of the methods above

- Simulate various permutations of portfolios generated by the methods mentioned above, aiming to verify whether a combination of methods generates portfolios superior to each method alone.

Want to learn more?

Email [email protected] to see our data room that dives deeper into our methodology and process.

What Our Current LPs Are Saying About Amphibian Capital

There’s a level of consistency and repeatability that shows they have strong manager selection skills

“I’m an investor in Amphibian because I believe they’re the best crypto quant fund of funds. The return on my ETH has far exceeded my expectations, and there’s a level of consistency and repeatability that shows they have strong manager selection skills. This is a fund that operates with discipline and the foresight needed in digital assets.”

Joey Krug

Partner at Founders Fund Former Co-CIO Pantera Capital

I feel more informed and better positioned for long-term gains

I had moved a substantial part of my portfolio from tech stocks into the ETH fund of funds, just before the FTX chaos hit. The risk and volatility in late 2022 were beyond anything I’d faced, but Amphibian's team was ready. Todd and James calmed my nerves with clear, frequent updates and even personal conversations. Now, I feel more informed and better positioned for long-term gains, thanks to their unique strategy and seasoned leadership.

James Workman

Founder AquaShares Inc.

Their diligence in analyzing our trades and strategy is both thorough and highly specific.

"I’ve had the pleasure of working with Amphibian Capital for nearly three years. Their diligence in analyzing our trades and strategy is both thorough and highly specific. They possess a deep understanding of various risk types and the corresponding expected returns. Amphibian Capital stands out as the most sophisticated and knowledgeable fund of funds I’ve encountered in this industry.""

Hugo Xavier

Co-Founder and Head of Trading K2 Trading Partners

Consistently deliver results with a disciplined approach

“We’ve seen James and his team at Amphibian consistently deliver results with a disciplined approach. Our confidence as experienced allocators is unwavering.”

Bendik Loevaas

CEO Jigeum Capital

Highly skilled and genuinely focused on aligning with their investors’ goals

"I have a lot of confidence in Amphibian Capital's team and their thoughtful, steady approach to navigating the volatile world we live in. Their performance has been stellar since I invested. What I value the most is the trust I’ve built with their leadership. The team is highly skilled and genuinely focused on aligning with their investors’ goals. I feel like a true partner in their journey, which has been a meaningful experience and most importantly we are all aligned in having pure intention of giving back via donating a large proportion of profits to worthwhile causes."

Ben Arbib

Founder Nurture Brands

The balance between risk and performance is well articulated and transparent

"I have been very pleased with the consistent performance of the funds I am invested in and the professionalism of team at Amphibian Capital. The balance between risk and performance is well articulated and transparent and the founders have always been generous with their time to provide market insight and answer questions. Whilst the BTC and ETC funds don’t have a long track record, I wouldn’t hesitate to recommend Amphibian Capital to friends and colleagues due to reasons aforementioned, including reliability."

James Burbidge

Managing Director Deutsche Bank

The testimonials provided are from Current Clients, Limited & General Partners of Amphibian Capital.

No compensation was provided for the statements, and the statements do not present any material conflicts of interests.